Insurance strategy planning is often viewed as a reactive measure—a way to protect against what might go wrong. Policies are purchased in response to immediate concerns, and coverage is often updated only after a loss occurs. But the most effective insurance strategies are not built on reaction—they are built on foresight.

Foresight in insurance strategy planning is the ability to anticipate future needs, emerging risks, and significant life changes, transforming insurance from a simple safety net into a strategic asset. It is about looking beyond the immediate and considering how coverage can evolve alongside personal goals, business growth, and shifting external conditions. This mindset prioritizes preparation over panic, resilience over repair, and strategic thinking over short-term fixes.

Understanding the Nature of Risk

At its core, foresight acknowledges that risk is dynamic. What seems secure today may be insufficient tomorrow. A young professional might start with basic health or renters insurance, believing they are adequately protected. However, as life evolves—marriage, children, homeownership, entrepreneurship—their exposure to financial and legal risks changes dramatically.

Without proactive planning, these milestones can create gaps in coverage that become apparent only in moments of crisis. For example, a family might discover that their health plan does not fully cover pediatric care or that their homeowners insurance excludes certain natural disasters. By anticipating these life transitions and adjusting policies accordingly, individuals ensure their insurance keeps pace with their evolving needs. In essence, foresight is about having the right insurance at the right time—not simply any insurance.

Foresight in Business Insurance Planning

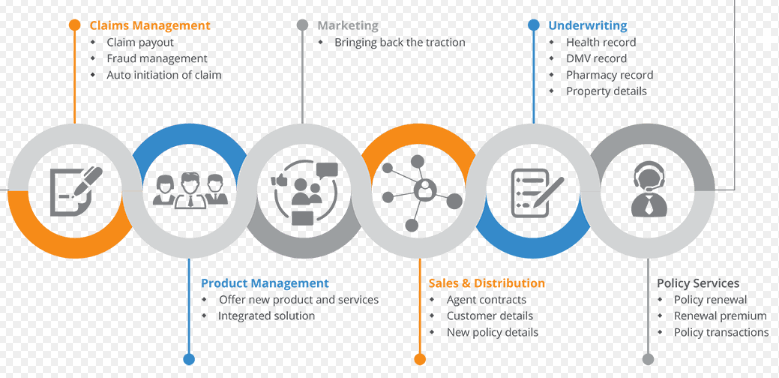

Businesses face parallel challenges. Startups and small enterprises often begin with limited coverage—general liability, property insurance, or workers’ compensation. As operations grow, so do risks. Cybersecurity threats, supply chain disruptions, employment disputes, and new regulatory requirements can all introduce exposure that earlier policies did not account for.

Foresight allows business owners to develop a flexible insurance framework that evolves alongside the organization. Regular policy reviews, strategic adjustments, and consideration of emerging risks ensure that coverage remains adequate and relevant. For instance:

Cyber liability insurance protects against data breaches that were uncommon for startups but critical as operations scale.

Business interruption coverage ensures revenue continuity during unforeseen disruptions, such as natural disasters or equipment failure.

Directors and officers liability insurance shields decision-makers from personal exposure arising from managerial actions.

This approach empowers businesses to pursue growth confidently, knowing they are prepared for potential financial and operational shocks. Rather than reacting to claims or regulatory demands, companies anticipate challenges and strategically allocate resources to protect their assets.

Reducing Financial and Emotional Stress

One of the most powerful aspects of foresight is its ability to minimize stress during crises. Thoughtfully structured insurance coverage provides clarity, control, and peace of mind. Individuals and families can focus on recovery, rather than being overwhelmed by financial uncertainty.

Consider a family faced with a medical emergency. If their health insurance includes comprehensive benefits, reasonable deductibles, and coverage for specialist care, they can prioritize treatment rather than worrying about mounting costs. Similarly, a business recovering from a natural disaster can resume operations faster if it has business interruption insurance and a clearly defined claims process.

These outcomes do not occur by accident—they are the result of strategic foresight. Anticipating potential scenarios, evaluating policy limits, and aligning coverage with realistic needs ensures that insurance serves as a true tool for stability rather than a reactive expense.

Integrating Foresight into Personal Insurance Planning

For individuals, building an insurance strategy with foresight requires evaluating current and future risks comprehensively. Key considerations include:

1. Life stage changes – Marriage, children, homeownership, career changes.

2. Asset accumulation – Higher-value homes, investments, or personal property may necessitate higher coverage.

3. Health considerations – Anticipating medical needs and long-term care requirements.

4. Legal and liability exposure – Ensuring personal liability coverage aligns with lifestyle changes, such as hosting guests or driving frequently.

By systematically reviewing these factors, individuals can proactively adjust policies, maintain adequate limits, and avoid unexpected gaps that could result in financial strain.

Foresight in Long-Term Wealth and Estate Protection

Insurance planning with foresight also intersects with broader financial and estate planning. Life insurance, disability coverage, and umbrella liability policies play a critical role in protecting wealth accumulation and ensuring that assets are preserved for future generations.

For example:

Life insurance ensures that dependents are financially secure in the event of untimely death.

Disability insurance safeguards income streams, protecting lifestyle and savings.

Umbrella liability coverage extends protection against lawsuits that exceed standard limits, safeguarding both personal and business assets.

Integrating foresight into these decisions allows for a comprehensive, layered approach to wealth protection that anticipates both foreseeable and unexpected life events.

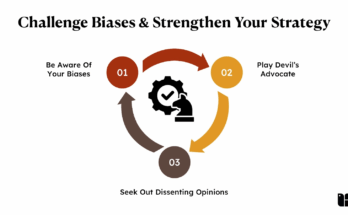

Regular Policy Review and Adjustment

Foresight is not a one-time effort. Life circumstances, economic conditions, and risk exposure change continuously. Regular reviews of insurance policies are essential to maintain alignment with evolving needs.

Annual evaluations ensure coverage reflects current assets, liabilities, and life stage.

Risk assessment updates identify emerging threats, such as cyber risks or new health considerations.

Policy adjustments guarantee that premiums remain reasonable while maximizing protection.

This iterative approach transforms insurance planning from a static safety net into a dynamic strategy that adapts to the realities of life and business.

Conclusion: The Strategic Advantage of Foresight

The role of foresight in insurance strategy planning is transformative. By anticipating future needs, recognizing evolving risks, and aligning coverage with life and business goals, insurance becomes more than a reactive measure—it becomes a proactive tool for stability and growth.

Foresight reduces financial and emotional stress, ensures continuity during crises, and protects both present and future assets. For individuals, it secures families, lifestyles, and wealth. For businesses, it safeguards operations, reputation, and long-term viability.

In a complex and unpredictable world, the most resilient strategies are those built on foresight. Anticipate changes, evaluate risks, and adjust coverage proactively. Doing so transforms insurance from a reactive obligation into a strategic advantage, empowering individuals and businesses to face the future with confidence and security.